Understanding Inflation: Causes, Effects, and Solutions

Understanding Inflation: Causes, Effects, and Solutions

Inflation is a key economic concept that refers to the sustained increase in the general price level of goods and services in an economy over a period of time. When inflation occurs, each unit of currency buys fewer goods and services, effectively decreasing purchasing power. While moderate inflation is often considered a sign of a growing economy, excessive or prolonged inflation can lead to economic instability. This article explores the causes, effects, and potential solutions for managing inflation.

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of money. For example, if the inflation rate is 3%, an item that costs $100 today will cost $103 next year. Inflation is typically measured using indicators such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), which track the prices of a basket of goods and services over time.

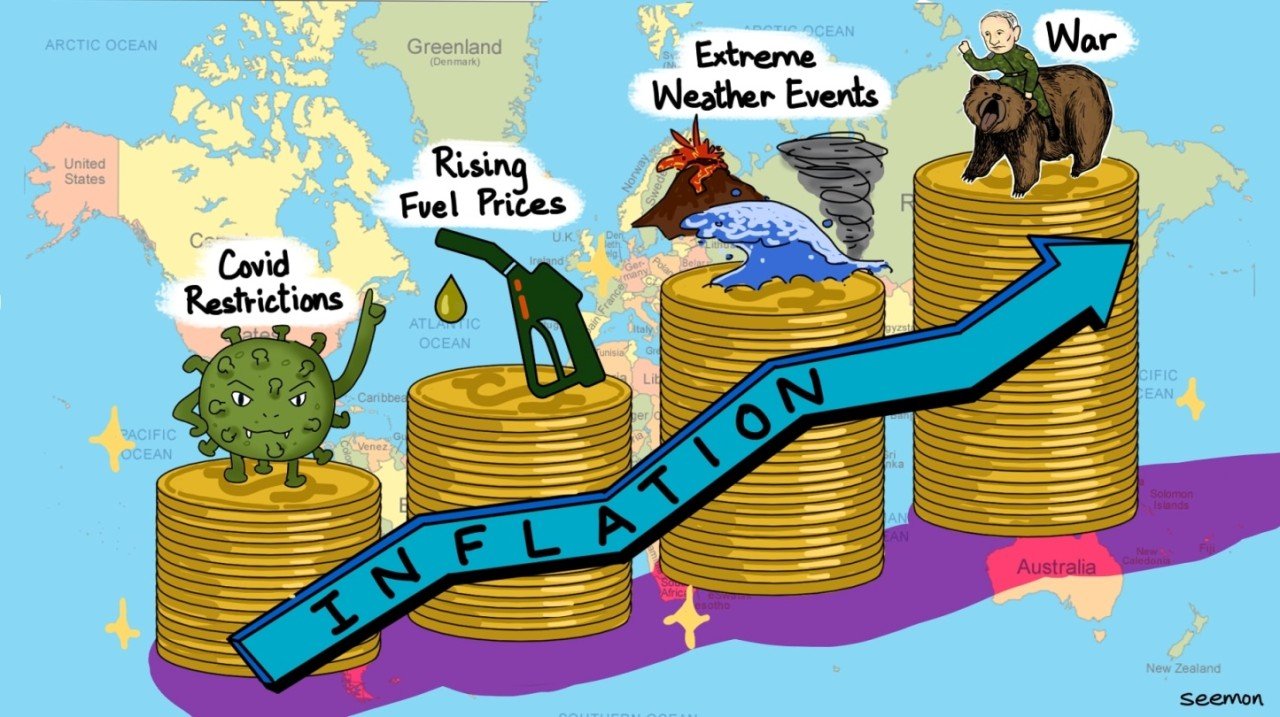

Causes of Inflation:

There are several key factors that drive inflation, which are broadly categorized into demand-pull inflation, cost-push inflation, and built-in inflation.

1. Demand-Pull Inflation

Demand-pull inflation occurs when the overall demand for goods and services in an economy exceeds the available supply. This increase in demand can be due to factors like rising consumer spending, increased government expenditure, or booming export markets. When demand outpaces supply, producers raise prices, leading to inflation.

2. Cost-Push Inflation

Cost-push inflation arises when the costs of production increase, causing producers to raise prices to maintain profit margins. Common factors that contribute to cost-push inflation include rising wages, increased prices of raw materials, and higher energy costs. For example, if the price of oil rises, the cost of transportation and production increases, leading to higher prices for goods.

3. Built-In Inflation

Built-in inflation, also known as wage-price inflation, is the result of a cycle where rising wages lead to higher production costs, which in turn lead to higher prices. As prices rise, workers demand higher wages to keep up with the increased cost of living, which further fuels inflation. This self-perpetuating cycle can be difficult to break.

Effects of Inflation:

Inflation has both positive and negative effects on different sectors of the economy, and its impact can vary depending on its severity.

1. Decreased Purchasing Power

The most immediate effect of inflation is the reduction in the purchasing power of consumers. As prices rise, consumers can buy fewer goods and services with the same amount of money, leading to a decrease in their standard of living.

2. Erosion of Savings

Inflation erodes the value of money over time, which negatively impacts savers. If the inflation rate exceeds the interest rate on savings accounts, the real value of savings declines. This discourages saving and encourages spending or investing in assets that may appreciate over time, such as real estate or stocks.

3. Uncertainty in the Economy

High or unpredictable inflation can create uncertainty in the economy. Businesses may hesitate to invest in new projects or hire more employees due to concerns about rising costs. Consumers may also delay large purchases, such as homes or cars, if they are uncertain about future price increases.

4. Income Redistribution

Inflation can lead to a redistribution of income, as it does not affect all sectors of society equally. For example, people with fixed incomes, such as pensioners, may see their purchasing power decline significantly during periods of inflation. On the other hand, borrowers may benefit from inflation, as the real value of their debt decreases over time.

Solutions to Control Inflation:

Governments and central banks use various tools to control inflation and ensure economic stability. Some of the common methods include:

1. Monetary Policy

Central banks, such as the Federal Reserve in the United States or the European Central Bank, use monetary policy to manage inflation. By adjusting interest rates and controlling the money supply, central banks can influence economic activity. For instance, increasing interest rates can reduce consumer spending and borrowing, which can help cool down inflation.

2. Fiscal Policy

Governments can use fiscal policy to control inflation by reducing public spending or increasing taxes. Reducing government expenditure can decrease demand in the economy, while higher taxes reduce disposable income, leading to lower consumer spending and reduced inflationary pressures.

3. Supply-Side Policies

To address cost-push inflation, governments can implement policies that encourage productivity and reduce production costs. For example, investing in infrastructure, reducing regulations, or providing tax incentives for businesses can help lower production costs, leading to reduced price pressures.

Conclusion:

Inflation is a complex economic phenomenon that can have far-reaching effects on both individuals and economies. While moderate inflation is a natural part of economic growth, high or uncontrolled inflation can lead to a decline in purchasing power, savings erosion, and economic uncertainty. By understanding the causes and effects of inflation, policymakers can implement strategies to manage inflation and ensure a stable and prosperous economy. Effective use of monetary, fiscal, and supply-side policies can help keep inflation in check and promote long-term economic growth.

Post Comment